Ever wondered how people who lived very middle class lives, after their retirement, just all of a sudden have everything? It’s not magic, neither is it luck.. it is consistent planning and saving. Every Pakistani needs to be in on this, to live a stable and peaceful life post retirement.

Here are some Desi hacks that will actually stabilize you financially once you retire.

1. Cut down on your wishes and start saving up. It doesn’t matter how much you earn, just remember, don’t spend it all!

2. You need a separate savings account, one like a piggy bank, which you have access to but cannot get inside till you break it. Just transfer whatever you’ve saved and let it be..

3. Save for when you need the money most – also make an emergency account for the rainy days. This will help keep the savings account intact, one which will be unbelievably full by the time you realize

4. Any bonus, extra income from your job, property, inheritance – anything that comes under the category of ‘bonus’ needs to be transferred in the savings account. ‘Katra katra samandar banta hai’

5. As your income increases, yearly, or whichever way – so should the portion of your savings

6. We suggest you never carry a credit card – it is the devil’s way of milking you dry. You will always pay more than if you had cash when you have a credit card

7. Even if you are saving as little as 1000 rs per month, that’s 12,000 annually, for starters – now imagine saving 10,000 rs per month – you can do the math…

8. DO NOT TRY TO HIT A SIX AND BECOME A CROREPATI – Don’t be stupid enough to invest in quick money making processes, that usually end up as scams

9. Invest in things that are well known and proven – in Pakistan, those things are property and gold

10. A harsh reality, which you need to act upon – don’t be too generous

So.. when do you start using these hacks? Where there’s a will, there’s a way.

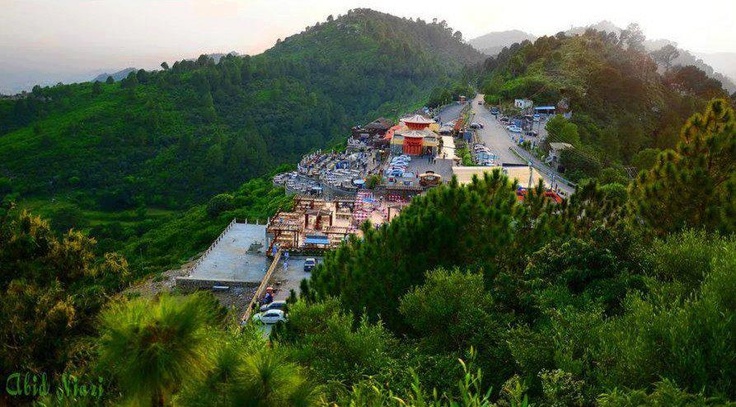

Also see: Is Bahria Town Icon Tower Stealing Shah Ghazi’s Limelight?

Also see: Is Bahria Town Icon Tower Stealing Shah Ghazi’s Limelight?

Also see: 9 Pakistani Superheroes Who Don’t Wear Capes

Also see: 9 Pakistani Superheroes Who Don’t Wear Capes